Winning and loosing are only loose signals of decision quality.

- Separate outcome quality from decision quality

- Separate luck from skill

- Quality of life = Σ of our decision quality + luck

- „Resulting„ – change the strategy just because a few hands didn’t turn out well in the short run

- Results are beyond our control

- „Hindsight bias“ – „I should have seen it coming“

- Type I error = false positive

- Type II error = false negative

Better be safe than sorry.

- Deliberative mind (= thin layer) vs reflexive mind

- Chess has a solution

- Life = bluffing and little tactics of deception

- John von Neumann = father of game theory

- We are dealing with hidden, incomplete information and luck

- We underestimate the amount and effect of what we don’t know

- Our lives are too short to collect enough data from our own experience, so we have to learn from history

- „I’m not sure“ = a step toward enlightenment (Stuart Firestein – Pursuit of Ignorance TED talk)

- The chances of alternative outcomes does not make us wrong when things don’t work out („it’s the 18%“)

- Only 100% or 0% can be wrong

- Second best is better than third best

- When you are betting, you have to pack up your belief by putting a price on it

- Incomplete information and factors outside of our control, we are uncertain and evaluate what we can

- We are betting against all the future versions of ourselves that we are not choosing

- Our default setting is to believe what we hear is true

Hearing is believing. – Susan Scutti

- We form beliefs rather efficient than accurate -> rethinking

- Truth seeking is not naturally supported by the way we process information, we alter our interpretation of that information to fit our beliefs = Biased Reasoning

- Fake news works because people already hold beliefs and do not question the evidence, beliefs are hard to change (snowball)

- Wanna bet? Ask the following questions and take an inventory of the evidence that informed us:

- Where did I get this info?

- How do I know this?

- Who did I get it from

- What is the quality of my sources?

- How much do I trust them?

- How up to date is my info?

- How much info do I have that is relevant to the belief?

- What other things like this have I been confident about that turned out not to be true?

- What are the other plausible alternatives?

- What do I know about the person challenging my belief?

- What is their view of how credible my opinion is?

- What do they know that I don’t know?

- What is their level of expertise

- What am I missing?

- There is always a degree of uncertainty, we are in a perpetual state of learning

- Rate your level of confidence about the accuracy of your belief on a scale of 0 to 10

- Goal: advance knowledge rather than affirm what we already believe

- Learning Loop

Belief -> Bet -> Outcome -> …… -> Luck

<-……………………….<- Skill <- ………….

- Backward = difficult

- „Motivated Reasoning“ – self serving bias, bad outcomes max luck, good outcomes max skill, see outcomes through a funhouse mirror, create a positive narrative

- All bad things can’t be your fault and all good things can’t be due to luck

- Bias slows learning down

- Respect the habit loop: keep the old cue and deliver the old reward, but insert a new routine

- We can modify our beliefs along a spectrum, it’s not a choice between opposites without middle ground

When you play the Game of Thrones you win or you die, there is no middle ground. – Cersei Lannister (Game of Thrones)

- Outcome <- cause 1, cause 2, cause 3 …

- Uncertainty in figuring out the various causes

- Turn negative outcome into positive outcome by finding things to learn from it

1. things you can improve

2. things you did well

3. things outside your control

- In the long run, the more objective person will win against the more biased person

- Accountability to accuracy = betting

- Interacting with similarly motivated people improves the ability to combat bias

- We crave approval so badly, we’ll still work to get it from a stranger; internalize the approval focus on accuracy on your own

- To avoid the effects of self-serving bias have a loss limit and answer to the group for your decision

- On our own we have just one view point, in a group you are exposed to diverse opinions, can test alternative hypotheses and move towards accuracy, get a more objective view of the world, we need other people to fill in our blind spots

- Well deployed diversity of viewpoints in a group can reduce uncertainty due to incomplete information

- We tend to gravitate toward people who are near clones of us

Never try to teach a pig to sing. It wastes your time and annoys the pig. – Mark Twain

- The pattern of confirmatory thought

- CUDOS – Robert Merton (1910-2003 )

Communism (data belong to the group)

Universalism

Disinterestedness

Organized Skepticism

- CUDOS can push a group toward objectivity (Robert Merton – The Normative Structure of Science, 1942/1973)

- Rule of thumb: if we urge to leave out a detail because it makes us uncomfortable or requires even more clarification to explain away, those are exactly the details we must share

- Rashomon effect: two accounts of the same event, but the versions are dramatically different, we can’t assume one version of a story is accurate or complete

- Universalism: the accuracy of a message should be evaluated independent of it’s source

- Practice to reinforce universalism: when I had the impulse to dismiss someone as a bad player I made myself find something that they did well -> deeper understanding of my opponent’s game -> devise counter strategies

- If the outcome is known it will bias the assessment so do not reveal the outcome

- How did the hand turn out? It doesn’t matter.

- Organized skepticism: ask why things might not be true

- Are you sure about it?

- Have you considered this other way of thinking about it?

- Lead with assent:“and“ instead of „but“

- Mental time travel, imagineer the conversation about the decision, stay on a more rational path, make better decision

- Recruit other versions of ourselves to act as our own decision buddie

- When we make in-the moment decisions we are more likely to be irrational and impulsive = temporal discouting?

- Create a habit routine asking ourself a set of questions to involve future-us and past-us -> 10/10/10 Regel = mental time travel

- Frame of the past: How would I feel today if I had made this decision

- 10 minutes ago?

- 10 month ago?

- 10 years ago?

- We’re ticker watchers of our own lives, that in-the-moment zoom lens amplifies our emotional response, our decision making becomes reactive, resulting in self-serving bias, decision driven by the emotions of the moment become a self-fulfilling prophecy

- It doesn’t so much matter where we end up as how we got there

- List of warning signs

- Illusion of certainty: I know; you’re 100% wrong

- Irrational outcome fielding/credit taking: I planned it perfectly

- Generalized characterizations to dismiss ideas: Idiot

- Accepting or not accepting a message because of the messenger

- Zoomed in on a moment „worst day ever“

- Conventional wisdom

- Including our own conclusion when asking for advice

- Terms that discourage engagement of others respond with „no“ or „but“, instead use „yes, and…„

- Reconnaissance – mapping the future

- Imagine the range of potential futures

- Belief -> Bet -> set of outcomes (future A, future B, future C, …)

- Backcasting, work backward from the goal imagining that an event has already occurred increases the ability to correctly identify reasons for future outcomes by 30% -> Pareto Prinzip

- Backtesting makes it possible to identify when there are low-probability events that must occur to reach the goal -> develop strategies to increase the chances those events occur

- Premortem, incorporating negative visualization makes us more likely to achieve our goals (Gabriele Öttinger Rethinking Positive Thinking)

- Red Team, definition: intelligence community’s conventional wisdom, are dedicated to arguing against and spotting flaws in logic and analysis

- Imagine both positive and negative futures helps us build a more realistic vision of the future

- We need to have positive goals, but we are more likely to execute on those goals if we think about the negative futures

- If we don’t hold all the potential futures in mind before one of them happens, it becomes almost impossible to realistically evaluate decisions or probabilities after

- Baumbild give the chainsaw a rest

- We will never be sure of the future

Thinking in bets when making financial decisions

- Bet = decision about an uncertain future = Trade

- Think in bets and apply it to decisions in financials markets

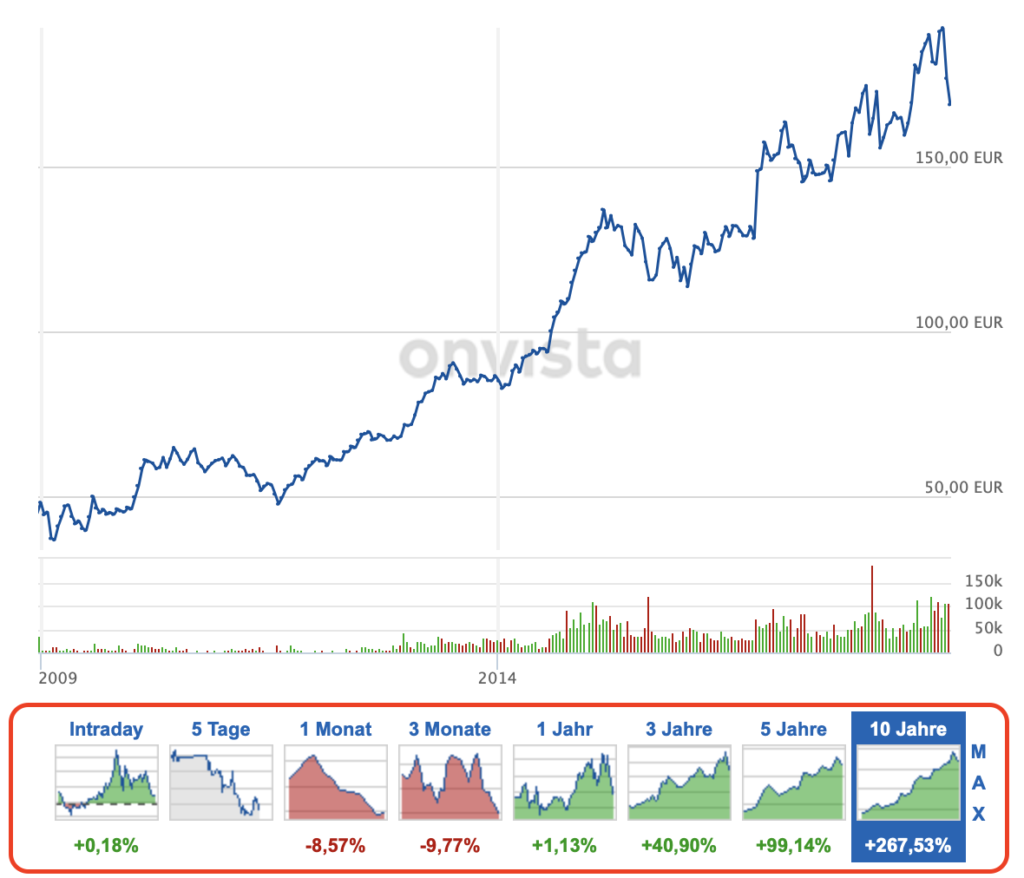

- Keep emotions out of the process, use a trading system and stick to it

- Don’t change your system just because a few trades didn’t turn out well in the short run

- A great decision is the result of a good process and the process accurately represents our own state of knowledge, like using my trading system

- If we misrepresent the world at the extremes of right and wrong (crash/high) with no shades of grey in between, our ability to make good choices (about how we are supposed to be allocating our resources) will suffer, this means for me to buy and sell continuously

- Decisions are bets on the future and they aren’t right or wrong, an unwanted result doesn’t make our decision wrong if we thought about the alternatives and probabilities in advance and allocate our resources accordingly, diversify over Trending, Growth and Value stocks

- Making better decisions = calibrating among the shades of grey (High <-x-x-x-x-> Low)

- Average 40% losses, loss aversion, redefine wrong

- You have to put your money where your mouth is

- Alternatives are: buy, sell, hold, not buy

- Put resources at risk, assess likelihood of different outcomes, what is it, that we value

- Best use of financial resources

- Outcomes are feedback -> analyze closed trades, what’s the lesson learned?

- Ulysses contract – raise a barrier against irrationality -> recommitment contract to be a more rational investor, stock-monitor

- Determining in advance the conditions under which you buy, sell or hold

- Scenario planning, amount vs. $ value x probability -> distribution of trades

- Dissenting opinions are represented in the planning -> stock loss

- We overestimate the impact of any individual moment on our overall happiness, the emotional equivalent is watching the ticker in the financial world

Some of the many book recommendations and links

- Wiki list of common misconceptions

- John Stuart Mill – On Liberty

- Woopmylife.org

Schreibe einen Kommentar